Labour Against Pensioners

Since early 1970s

Slideshow Examples of Labour against pensioners,

especially women and specifically against 1950s to 1980s born ladies

Equality of Pension Age 60 for Men Denied by Labour

..."When planning the first Sex Discrimination Act (1975) in the early 1970s, it is believed that Barbara Castle (Labour government Minister) had wished to include an

equal state pension age of 60 (for men same as women) in its remit, but later dropped this idea when

(Labour) Prime Minister Jim Callaghan responded with ‘do you want me to bankrupt the country?’ Nor did it feature in the subsequent

1984 Sex Discrimination Act."...

Right wing Labour had won power over the party again by then.

(Source PARITY formerly CESPA men's equality group)

We know that subsequent governments would not have risen men's pension age, as done against women.

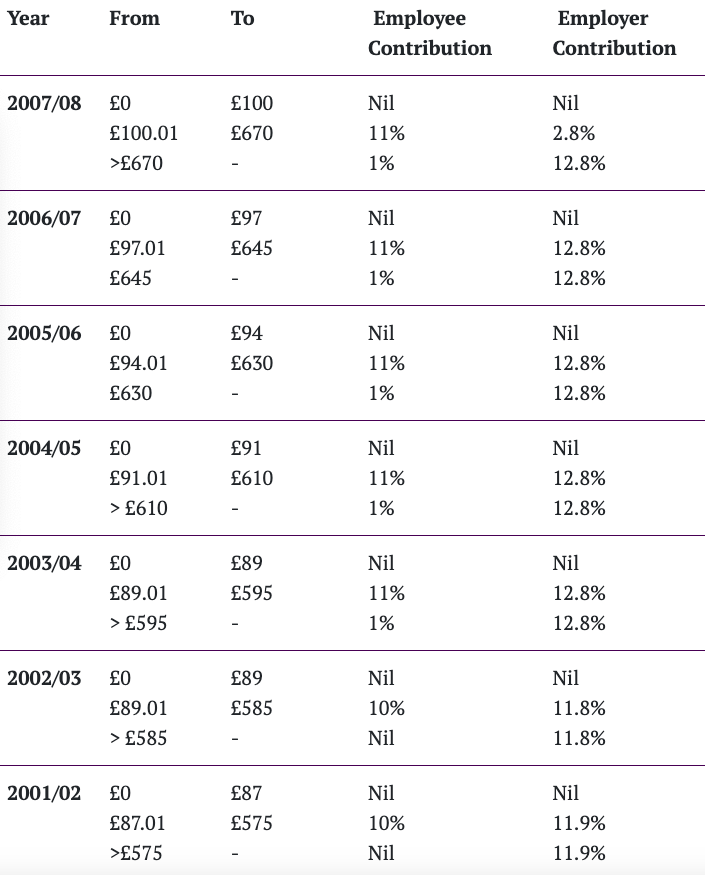

The history of the top waged, mostly men, paying from 2003 only 1 per cent, then 2 per cent from 2011 onwards, on top wages (above maximum salary threshold) for worker National Insurance contributions, is another discrimination done by Labour in their governments. It meant if the rich had paid full worker National Insurance contributions on ALL their wages, then better state pension money and pension age 60 could easily have been afforded.

CONTRACTED IN NATIONAL INSURANCE RATES

The description by Labour MP Gerald Kaufman (b.1930) of Labour's 1983 election manifesto as the longest suicide note in history, shows Labour again enemies of the state pension.

1983 Labour manifesto included pension policies of :

- common pension age of 60.

- Give women the additional tax allowance for the elderly - the age allowance - at 60 instead of 65.

- Phase out the TV licence for pensioners.

- Link pensions and average earnings, when these are rising faster than prices.

Link to manifesto CLICK HERE

Pensioners Got Poorer Under Blair and Brown's Labour government

History of Labour against especially women pensioners

under Blair and Brown's government 1997 to 2010

- It was Labour who betrayed the 1950s to 1980s born women by not getting rid of the Tory 1995 pension act that rose women's pension age from 60 to 65 and Labour added pension age 66 with Labour's 2007 pension act.

- It was Labour who further betrayed the 1960s to 1980s born women by raising pension age to 67 and 68 (2007 pension act).

- It was Labour who ended Widows Pensions before age 60.

- It was Labour who rose early works pension age

from 50 to 55

(2004 Finance Act, law in 2010).

- It was Labour who continued stopping the prior version of triple lock on the lowest state pension of any rich nation on earth.

Prior version of triple lock had begun to be stopped by Thatcher in 1980.

Labour raising state pension, for example, only by 75p per week in 1999. - It was Labour that did not uncouple Pension Credit from women's pension age and keep it at 60, for men and women, and all the other pensioner benefits at 60, knowing the harm that would do to the poorest men and women when state pension age rose.

- Labour also knew pension age rise would kill, as their own government actuaries told them back in 2005.

Labour government from 2024

REEVES SAID IN PARLIAMENT IN 2014 means testing Winter Fuel Payment when Labour next back in government.

So both Starmer and Reeves have lied now that stopping Winter Fuel Payment for all pensioners was a new decision. She is calling us pensioners, rich.

Ten years ago, Reeves wrote, with all the compassion of a spreadsheet: “We will vote for a cap on welfare spending to keep the overall costs of social security under control.” How chilling those words seem now, as millions of pensioners face the prospect of shivering through winter, their radiators as cold as Labour’s heart.

But let us not forget Reeves’ crowning achievement in doublespeak: “We’re not the party to represent those who are out of work,” she proudly declared in 2015. One wonders if she now considers pensioners, those who have toiled for decades and earned their rest, as part of this undesirable demographic.

Labour does not want to represent people out of work

‘Labour are a party of working people, formed for and by working people’

Rachel Reeves, Labour MP

Rachel Reeves planned an assault on

Winter Fuel Payment a decade ago.

Hansard debate on Tuesday 25 March 2014

We are the party who have said that we will cut the winter fuel allowance for the richest pensioners and means-test that benefit to save money,

but Government Members do not support that. The reality is that we are the party who are willing to take tough decisions to get the welfare bill down, whereas it is rising, not falling, under this Government.

POTENTIAL LOSS OF COUNCIL PENSION

"Councillors in Tameside (Greater Manchester) have been resistant to the idea of merging their own plan (Local Government Pension Scheme), which generates a large surplus, with Reeves’s (Chancellor Rachel Reeves)

‘bulk’ scheme, saying that its success should benefit current and past Greater Manchester council staff instead of enriching the Treasury or funding potentially far more risky and less profitable investments.

But now the Labour national executive (NEC) has seized control both of Tameside Council and the selection processes for councillors – and is said to be setting up resistance councillors for deselection to smooth the road for Reeves’s pension grab."...

BACKGROUND

Angela Madden, WASPI Leader, appeared on GB News as an authority on a subject she knows nothing about, as obviously not a council works pensioner, as the megafund idea by the pensioner-hating Chancellor Rachel Reeves, is the same thieving endeavour by the Tories back in 2015 to spend away the council pension funds, when there is no Pension Protection Fund and no right to pension payment if the council goes bust. Up to half of councils might go bust in next five years, we are told by the finance world.

WHAT IS THE LGPS?

The Local Government Pension Scheme system is one of the largest pension schemes in the UK, with over 6 million members and are mostly basic money, especially to the majority of employees that were low waged women.

HOW MANY IN ENGLAND AND WALES COUNCIL PENSION SCHEMES BY 2024

The LGPS is administered locally by 86 local pension funds in England and Wales.

Across England and Wales the LGPS currently has 6.7 million members:

- 2.1 million people are currently paying into the LGPS

- 2.1 million people are being paid a pension from the LGPS

- 2.5 million have a pension with the LGPS that they have not taken yet

- Over 18,000 employers participate in the LGPS.

In March 2024, the market value of the LGPS was £391 billion.

( https://www.lgpsmember.org/about-the-lgps/about-the-lgps/ )

HOW MANY IN SCOTLAND COUNCIL PENSION SCHEMES

The figures

Across Scotland the LGPS currently has 638,558 members:

- 263,330 people are currently paying into the LGPS

- 201,685 people are being paid a pension from the LGPS

- 173,543 have a pension with the LGPS that they have not taken yet

- Over 460 employers participate in the LGPS.

( https://www.scotlgpsmember.org/about-the-lgps/about-the-lgps/# )

HOW MANY IN ULSTER COUNCIL PENSION SCHEMES

- Total members (2024) 169,490

- Active contributing members 84,090

- Deferred members 39,689

- Pensioner members 45,711

(

https://nilgosc.org.uk/about-us/who-we-are/ )

AVERAGE COUNCIL WORKS PENSION AMOUNT

Lord Hutton

Chair, Independent Public Services Pensions Commission

30 July 2010 Call for evidence to the Public Service Pension Commission

The average pension paid under the scheme is £4,044 a year (men mostly)

And UNISON informed back in 2010 that the LGPS paid:

The average pension of … £2,600 for women

LABOUR'S MEGAFUND PROPOSAL

Re yet another law against pensioners from the pensioner hating Rachel Reeves, Chancellor is the mega fund idea:

pooling of assets from 86 Local Government Pension Scheme authorities … local government pension schemes (LGPS) into eight funds, worth about

£50 billion, by 2030

The government has now published the outcome of its Pensions Investment Review and is consulting on its megafund proposals.

Like any pensioners we have much to fear that this government does not have the best interests of pensioners at heart.

GOVERNMENT ABLE TO TAKE FUNDS OUT OF LGPS BY MEGAFUND PROPOSAL

Bearing in mind the government also set out proposals to enable transfers without consent into either a trust-based or contract-based arrangement to aid the shift to fewer, larger schemes.

( https://www.ftadviser.com/pensions/2024/11/15/pensions-minister-megafunds-are-a-win-win-situation/ )

This is what the Labour Prime Minister Callaghan did from back in 1978 in taking all public sector staff out of the 2nd state pension (SERPs aka State Second Pension) that now hits by reduction, even when have far more than 35 years National Insurance record, for the 1950s born retired since April 2016. Losing hundreds if not thousands of pounds each and every year down from the full new flat rate state pension amount.

WHAT IS THE PROBLEM?

The government saying the investments would be in new start-up private Companies and … wider range of assets such as unlisted companies and infrastructure projects, which latter sounds very much like the prior Tory idea of spending away the council works pension.

The government said consultation on the plans will open soon, but they echo those made by former Tory governments.

Former prime minister David Cameron’s bid to push local funds into eight larger pools in 2015 has seen only about 39 per cent of LGPS assets being pooled into larger funds so far.

Infrastructure projects surely are government commissioned works to private companies, which we have seen go over budget and therefore no profit by investment in such as the white elephant of HS2.

infrastructure that is a long-term investment that gives you a better return over the longer term

From Institute of Government website re HS2:

Lord Berkeley estimated that HS2 would only deliver £0.66 for each public pound spent

Pensioners live from day to day and do not have long term left of life.

DANGER OF COUNCILS GOING BUST

We have councils going bust more and more, such as Northamptonshire County Council back in 2018. With various Borough Councils going bust more than once in a year.

The BBC informed back 5 March 2024 -

- half of councils warning of effective bankruptcy within five years without reform.

Councils technically can't go bankrupt - but they can issue what's called a section 114 notice, where they can't commit to any new spending, and must come back with a new budget within 21 days that falls in their spend

And in the same BBC article Jonathan Carr-West, chief executive of think-tank the Local Government Information Unit

Informed:

But there's also been a systemic problem with local government financing. Over the last 13 years, we've seen the amount of money that central government gives to local government reduced by more than 40%

Analysts at financial rating firm Moody's said they expect more local authorities to "fail over the near term" due to lost value of commercial property, high inflation, interest rates and service demand.

And The Commons Library 13 September 2023 informs:

Local authorities in England have seen considerable reductions in the grants they receive from the Government since 2010. The National Audit Office estimated in 2018 that local authorities’ spending power had fallen by 29% in real terms between 2010/11 and 2017/18.

The Institute for Government estimates the fall in spending power as 31% between 2009/10 and 2021/22.

And Mr Oakford of Kent County Council informed in that same BBC article if council funding reduced still further:

Local government will become a provider of statutory services […] everything else will disappear. Local government will become meaningless

EXAMPLE OF SUCCESSFUL LGPS

You informed us pension members

Staffordshire Pension Fund ("the Fund") invests a large proportion of the Fund in non-Sterling (£) denominated assets

Which shows Staffordshire Pension Fund see UK asset investment as not a secure investment strategy.

And your Chairman’s report 2022-2023 informed us members of the LGPS :

Due to better-than-expected investment returns over the last 3 years, the funding level of the Fund improved from 99%, at the last valuation, to 120% at this valuation and work continues with Hymans to help the Fund to protect this level of funding going forward.

So why would Stafford’s LGPS be lumped with failing councils?

NO PENSION PROTECTION FUND FOR COUNCIL WORKS PENSIONS

And we are informed on the Henry Tapper website back in March 11, 2018:

• A LGPS can go bust …and ... be taken over by government commissioners• LGPS administration authorities have a legal obligation to meet pension benefits

But the legal obligation is then negated by the below information:

• LGPS members have no statutory rights to have their benefits paid if an LGPS fund ran out of money to pay them• What is likely is the benefits would be reduced to a level the government would need to meet payments if they couldn’t• There is no PPF for their benefits

PPF is the Pension Protection Fund.

We should fear all 86 council works pensions becoming a single mega fund, that means could have all council works pension going bust and unable to pay pensioners.

Our pensioner representatives also have grave reservations:

Speaking on behalf of the National Pensioners’ Convention (NPC), retired civil servant Clare Wilkins warned against amending existing schemes to the detriment of local government workers.

She added: “Any change needs to be made solely in the best interests of those workers who pay in to the scheme and protect their pension in retirement.”

Unison assistant general secretary Jon Richards also warned that “the devil will be in the detail.”

He said: "It’s crucial the voices of scheme members — including council workers, school support staff, and many others delivering public services — are central to any changes.”

And GMB national pensions organiser George Gergiou informed:

..."it’s putting hope over experience” to believe that larger pools would bring about efficiencies of scale.

He said: “All the evidence points to the opposite, returns are down and asset management costs have doubled in the last accounting period.

Might the Chairman of Staffordshire LGPS also consider, please, full trustee status to members (us pensioners and workplace contributors) of the Staffordshire LGPS so as to help control investments, meaning national UK government cannot achieve the mega fund danger to council pensioners such as myself?

Sources:

https://www.ftadviser.com/pensions/2024/11/15/pensions-minister-megafunds-are-a-win-win-situation/

https://www.bbc.co.uk/news/uk-politics-66878229

https://commonslibrary.parliament.uk/what-happens-if-a-council-goes-bankrupt/

https://henrytapper.com/2018/03/11/could-a-local-government-pension-scheme-go-bust/

That has verification by

"one of ten websites and blogs every investor should bookmark"- The Times.

https://morningstaronline.co.uk/article/reeves-plots-mega-raid-on-pensions-union-warns

https://www.instituteforgovernment.org.uk/explainer/hs2-costs